Accounting Services

We take great care in the accounting and management of the Association’s assets.

Your Accounting Team

Amy Johnson

Senior Vice President, Accounting

19 Years of Industry Experience

13 Years with CIMS

April Borba

Senior Director, Accounting

6 Years of Industry Experience

6 Years with CIMS

Jennifer Bueno

Senior Director, Accounting

20 Years of Industry Experience

20 Years with CIMS

Best Practices in Accounting Controls

Onboarding and Financial Health Checklist

As part of the onboarding process, we look at the accuracy of current financial reporting and compliance

with civil code, governing documents and best practices.

Financial Health Checklist

Account for all Funds & Bank Accounts

Review Governing Documents & Policies

Confirm Budget Follows CC&Rs

Flag Conflicts with Current Practices

Identify Anomalies in Bookkeeping

Report & Recommendations to Board

Financial Health Checklist

Account for all

Funds & Bank Accounts

Review Governing

Documents & Policies

Confirm Budget

Follows CC&Rs

Flag Conflicts with

Current Practices

Identify Anomalies

in Bookkeeping

Report &

Recommendations

to Board

Monthly Financials: What You Can Expect

Real-time access to financial and homeowner data, including account histories and collections

Workflows to ensure financial statements are prioritized based on board meeting schedules

Electronic notification and access to financial statements immediately upon completion

Customized accounting cover letter highlighting activity and items for review each month

Integration with banking partners for quicker access and automatic download of bank statements

Online check signing and real time access to all invoices, including status and images

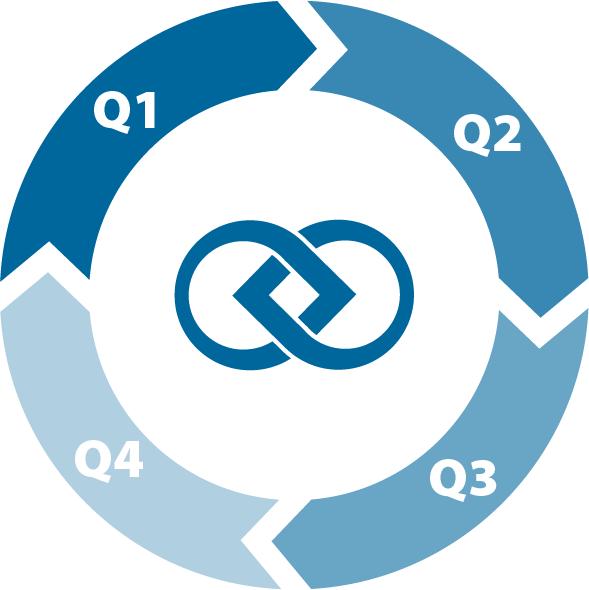

The Budget Life Cycle

The budget is one of the most important aspects of HOA management. It is the foundation for annual planning, maintenance, capital improvements, and the overall protection of HOA assets and homeowner property values. The budget approval process should not feel rushed or incomplete. We focus on the budget throughout the year and help the Board feel prepared to make prudent, timely and pressure-free decisions.

Q1

Evaluate and plan for major projects in the current year. Obtain proposals and approve the annual reserve study for the next fiscal year.

Q2

Evaluate the current budget for significant variances. Obtain and review the preliminary reserve study draft.

Mailing of budget package in accordance with civil code and CC&R requirements.

Q4

Provide draft budget (with reserve study) to Board 5 months prior to fiscal year end. Board meeting(s) to review draft budget and planning for next fiscal year.

Q3

The Budget Life Cycle

Q1

Evaluate and plan for major projects in the current year.

Obtain proposals and approve the annual reserve study for the next fiscal year.

Q2

Evaluate the current budget for significant variances.

Obtain and review the preliminary reserve study draft.

Q3

Provide draft budget (with reserve study) to Board 5 months prior to fiscal year end.

Board meeting(s) to review draft budget and planning for next fiscal year.

Q4

Mailing of budget package in accordance with civil code and CC&R requirements (30-90 days prior to fiscal year end).